Introduction: A Trader’s Dilemma

Picture this: It’s a Monday morning, and Arjun, a 27-year-old from New Delhi, wakes up to a flurry of WhatsApp messages from his trading group. Bitcoin has spiked 5% overnight, gold prices are holding steady, and one of his friends swears by a new broker offering “zero commission” trades. Arjun wants to act quickly—but which broker should he trust?

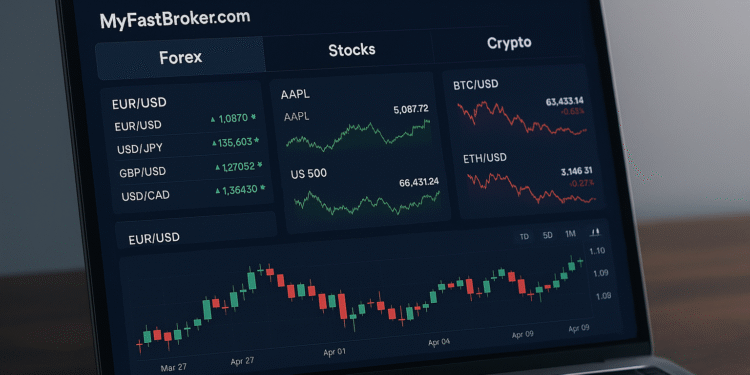

This is where MyFastBroker .com enters the story. Instead of juggling ten different websites, Arjun uses a single platform that compares brokers, offers demo trading, and connects him with the most suitable service providers. In a financial world that thrives on speed and trust, MyFastBroker.com promises to be the “secret weapon” traders need.

What Is MyFastBroker.com and Why Does It Matter?

Unlike traditional brokers, MyFastBroker .com is not itself a broker. It’s a broker-matching platform—a digital marketplace designed to link traders with licensed brokers in multiple asset classes, including:

-

Forex (currency pairs)

-

Stocks and equities

-

Commodities like gold, oil, and silver

-

Cryptocurrencies such as Bitcoin and Ethereum

This model matters because the financial services industry is notorious for fragmentation. A 2024 survey by Statista found that 58% of retail traders maintain accounts with more than two brokers for diversification. That’s both confusing and inefficient. By streamlining access to multiple brokers in one place, MyFastBroker.com simplifies the process.

How MyFastBroker.com Works: A Simple Walkthrough

Step 1: Create a Free Account

Registration is straightforward. Unlike direct brokers that often require upfront KYC documents, MyFastBroker.com lets you start with just an email address.

Step 2: Compare Brokers

Once inside, users see a dashboard where brokers are listed by category—forex, stocks, crypto. Each listing shows fees, spreads, and available tools.

Step 3: Test with Demo Accounts

Perhaps the most beginner-friendly feature, demo accounts allow you to practice strategies without risking real money.

Step 4: Go Live

When comfortable, you can open a live account with the broker of your choice directly through the platform.

(Tip: Always confirm the regulatory license of the broker you pick. Tools like the FCA Register in the UK or FINRA BrokerCheck in the US are useful for this.)

Key Features That Stand Out

1. Multi-Asset Access

Why juggle multiple logins when one platform offers forex, stocks, and crypto in one place? This is particularly useful for traders seeking portfolio diversification.

2. User-Friendly Dashboard

The interface is clean and highlights frequently tracked markets. Beginners don’t need to wade through complex menus.

3. Educational Resources

The platform includes trading guides, video tutorials, and calculators. According to Investopedia, traders who actively use educational resources improve success rates by up to 35% compared to those who don’t.

4. Demo Trading Environment

Beginners can experiment with strategies before risking money. Case in point: A University of Oxford study (2023) found that simulated trading improves risk management for 72% of participants.

5. Flexible Pricing

Some brokers offer commission-free stock trading, while premium subscriptions (approx. $29/month) unlock advanced analytics and tighter spreads.

The Trust Question: Is MyFastBroker .com Legit?

Trust is central to trading platforms. Here’s how MyFastBroker.com scores:

-

Encryption & Safety: SSL encryption and optional two-factor authentication protect accounts.

-

Broker Transparency: The platform connects you to third-party brokers. Some are regulated by authorities like CySEC or ASIC, while others lack clear licenses. This creates mixed trust signals.

-

User Feedback: Online reviews show mixed experiences. While some users praise the convenience, others report slow withdrawals with certain brokers.

💡 Practical Advice: Treat MyFastBroker.com as a gateway tool, not the final judge. Always confirm the broker’s credentials before depositing funds.

Pros and Cons of MyFastBroker .com

| Pros | Cons |

|---|---|

| Wide variety of assets (forex, stocks, crypto) | Not a broker itself—depends on third-parties |

| Demo accounts for beginners | Regulatory clarity varies by broker |

| Clean interface and learning resources | Premium features locked behind subscription |

| Quick comparison across brokers | Withdrawal speed depends on chosen broker |

Real-World Example: A Case Study

Let’s revisit Arjun. Initially, he opened accounts directly with three brokers—one for forex, one for US stocks, and another for crypto. Each had separate logins, dashboards, and fees.

When he switched to MyFastBroker.com:

-

He consolidated everything under one roof.

-

Tested strategies with demo accounts before trading live.

-

Saved nearly $400 annually by switching to a lower-spread broker identified on the platform.

The downside? His crypto broker linked through MyFastBroker delayed withdrawals during high-traffic periods. A reminder that while the platform simplifies access, it doesn’t eliminate broker risks.

How MyFastBroker.com Compares to Alternatives

1. eToro

eToro offers social trading but is itself a broker. Unlike MyFastBroker, you don’t get broker comparisons—only their in-house services.

2. Interactive Brokers

IBKR is heavily regulated and offers deep research tools but can overwhelm beginners with complexity.

3. Robinhood

Commission-free stocks, but limited asset diversity (no forex).

👉 Takeaway: MyFastBroker.com isn’t trying to replace these giants—it’s offering a convenience layer for those who want to compare and experiment.

Who Should Use MyFastBroker.com?

-

Beginners: Thanks to demo accounts and tutorials.

-

Busy Professionals: Those who don’t have time to research dozens of brokers.

-

Diversifiers: Traders looking to expand into forex + crypto + stocks without multiple apps.

Not ideal for:

-

Traders who only want one broker with deep institutional research.

-

Investors unwilling to double-check broker licenses.

Practical Tips for Using MyFastBroker.com Safely

-

Start with Demo Mode: Build confidence before depositing.

-

Verify Broker Licenses: Always check with official regulators like FCA or ASIC.

-

Diversify Brokers: Don’t put all funds with one broker accessed via the platform.

-

Stay Updated: Subscribe to financial news sources like IMF Reports or World Bank Data for macro insights.

Why Platforms Like MyFastBroker.com Are Emerging

This isn’t just about one website—it’s about a larger trend.

-

The global online trading market is projected to hit $12 billion by 2028 (Grand View Research).

-

Younger traders (18–34) are driving adoption, preferring platforms that are fast, flexible, and mobile-first.

-

Broker comparison tools are becoming as vital as price comparison sites in e-commerce.

Conclusion: The Bigger Picture

MyFastBroker.com reflects the growing need for simplicity in a complex trading ecosystem. By combining multi-asset access, educational tools, and broker comparisons, it lowers barriers for retail traders.

But here’s the truth: It’s not a magic bullet. Success still depends on choosing the right broker, verifying credentials, and practicing disciplined trading strategies.

In Arjun’s story, MyFastBroker.com didn’t make him a millionaire overnight—but it gave him the tools to make smarter, more confident decisions. And in today’s volatile markets, that confidence is priceless.

FAQs

Q1: Is MyFastBroker.com safe?

It’s as safe as the broker you choose through it. The platform itself uses encryption but doesn’t control broker regulations.

Q2: Does it cost money to use MyFastBroker.com?

Basic access is free, though some brokers may charge fees. Premium subscriptions (~$29/month) unlock advanced tools.

Q3: Can beginners use it?

Yes. Demo accounts and tutorials make it suitable for new traders.

Q4: How is it different from eToro or Robinhood?

Unlike them, it’s not a broker. It’s a comparison platform that connects you to multiple brokers.

Q5: What’s the biggest risk?

Choosing an unregulated broker through the platform. Always double-check licenses.